Happy New Year 2026!

Here's to growth, innovation, and community in the year ahead.

IFoA Membership Expiring 31 December?

Join INQA instead – AI resources, peer community, no regulatory overreach, society-agnostic membership.

From £65/year (+ £20 one-time verification, + VAT if applicable)

Join INQA Today2× or more Productivity with AI + Professional Infrastructure

Two ways to benefit:

Add INQA · £65–90/year (≈0.1% of salary) Replace membership · save ≈£650/year

Get AI playbooks, AI‑powered forums and agents, credible STV polls, and working parties.

Eligible actuaries: IFoA (UK), SOA (US), CAS (US), CIA (Canada), ASSA (South Africa), Actuaries Institute (Australia), Institute of Actuaries of India, Israel Association of Actuaries, Society of Actuaries in Ireland.

A respected actuary and IFoA double gold medallist has raised serious concerns about the value that the IFoA offers to ordinary members and its handling of disciplinary proceedings.

Read Prof. Wilkie's Full Assessment →Infrastructure Matching or Surpassing Traditional Actuarial Bodies

Modern tools built for today's actuaries

Member Forums

Anonymous, pseudonymous, or public discussions with 24/7 AI agent support and insights.

Credible Polls

STV voting system with verified members only. No gaming, no duplicate votes—reliable data.

Working Parties

Collaborate on projects, research, and initiatives with fellow actuaries (and also non actuaries) worldwide.

AI Productivity

c 2× productivity multiplication with AI agents, playbooks, and automation tools.

For Qualified Actuaries: Simplified Membership

Verified plans from just £6.50/month with streamlined verification

View Qualified Actuary PlansWelcome

International Qualified Actuaries Group makes remaining a qualified actuary not only less hassle, but also cheaper. (See "Who is eligible to join" in Commonly Asked Questions below for the 9 actuarial organisations we currently accept verified members from).

Explore Membership Options Login with LinkedIn

Once you have joined one of our flexible monthly payment plans, we will verify that you have the qualification you say you have and record it in the directory. Professional indemnity insurers, employers, clients, prospects, regulators and others will be able to check your status via our "Verify Member Status" service.

Key point!

Getting to a better membership place

Much better value for money. An end to over-regulation. More interactive digital content.

Are you frustrated by:

- Very high membership subscription fees

- Increasing overreach of professional regulation

- Intrusion by your professional body into your personal life?

New in 2025: Improved Membership Process

Our new platform streamlines the membership experience:

- Complete the application process entirely online

- Pay securely through our automated payment system

- Manage your subscription with self-service tools

While verification still requires manual review by our team (typically a few days), all other aspects of membership management are now instant and automated.

Benefits of verified membership

Services that provide great value for money, including:

- public verification that you obtained your qualification. Insurers, employers, clients and others can see a public verification that you passed the exams to gain your qualification

- public verification that you abide by and have met a code of professional conduct

- digital services that are far more interactive than with traditional actuarial bodies

- a code of professional conduct that avoids overreach into personal life

- putting the power of competition to work, to reduce the quasi monopoly power of existing bodies.

Testimonials

Platform Upgrade Feedback

"Congratulations! It's a huge achievement"

— Experienced actuary commenting on our platform upgrade (May 2025)

Why Members Choose INQA

"I want more focus on technical excellence, new emerging technical areas, true professionalism - all without the ideological and political capture in evidence currently."

— IFoA Fellow

"This is great. Many people will join. It's a no brainer and value for money."

— Experienced actuary

"Thanks for all the hard work and voicing out for us, Patrick!"

— IFoA Fellow

Actuarial Freedom

"Save for a small number of highly specialist roles, there is no statutory requirement that actuaries are members of the IFoA in order to carry out the role of an actuary."

— Legal statement in UK High Court proceedings (2022)

"I doubt [the International Qualified Actuaries Group] will get any members."

— Senior executive at a traditional actuarial body (January 2025)

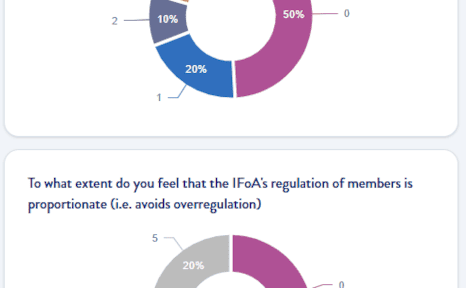

Member Satisfaction Data

Initial registrants for NewOrg (the stealth name for INQA GROUP) rated the IFoA:

- 1.4/10 for "value for money with regard to membership fees"

- 1.8/10 for "proportionality of regulation (i.e. avoids overregulation)"

How to Get Started

- View our membership plans and select the option that's right for you

- Complete the streamlined verification process (takes just minutes)

- Enjoy immediate access to member benefits based on your selected plan

Why is the International Qualified Actuaries Group needed?

INQA GROUP's founder, Patrick Lee, was a Fellow of the Institute of Actuaries for 31 years, including 7 years spent on IFoA Council and 2 on its Management Board. As a business owner he experienced first hand the frustration of having to pay very high membership fees for IFoA Fellowship, and also the increasingly overbearing nature of the IFoA's regulation. The benefits obtained in return did not appear to be proportionate. He was also President of the Wessex Actuarial Society for over 8 years.

The annual membership fees/dues for several other associations also seem high in comparison to the benefits offered to members.

In INQA GROUP Patrick combines his experience of running actuarial organisations with over 30 years of software development, specialising in web and cloud services.

We want to provide you with a professional membership experience that is high quality, but also excellent value for money, far more transparent and with proportionate regulation.

.png)

Membership Plans

View our membership options with verification and premium features for qualified actuaries.

View Membership PlansAdditional or changed services and annual pricing updates

We reserve the right to charge extra for additional services and to increase prices annually in line with any rise in retail price inflation. As membership increases we also reserve the right to vary the pricing plans (e.g. to provide additional or different services in response to member feedback) but we are committed to the principles of value for money and transparency.

Enterprise Solutions for Actuarial Teams

Upskill your actuarial team with AI productivity training. Bulk membership packages available for employers and training providers (10+ seats).

Commonly Asked Questions

At the present time (2024) Qualified Actuaries (Fellows or Associates) who obtained their qualification from the following organisations are eligible for verified membership once their qualification has been verified:

- Actuarial Society of South Africa

- Actuaries Institute of Australia

- Canadian Institute of Actuaries

- Casualty Actuarial Society

- Institute and Faculty of Actuaries (or its precursors: Institute of Actuaries, Faculty of Actuaries)

- Institute of Actuaries of India

- Israel Association of Actuaries

- Society of Actuaries

- Society of Actuaries in Ireland.

These organisations have been chosen because of their broad similarity (as reflected by their connection via bilateral mutual recognition agreements for each organisation above with at least one other organisation above, either equating Associate to Associate, or Fellow to Fellow, or both) and very significant examination requirements in addition to a university degree.

No. In the same way that some actuaries are members of both the IFoA and the (US) SOA or the (South African) ASSA or the SAI (Ireland), there is no restriction from INQA GROUP's point of view on members joining other organisations at the same time. (Such a restriction would arguably be anti-competitive and illegal, as indeed would for example a restriction placed by another body on actuaries joining INQA GROUP). But note that since INQA GROUP's membership fees are designed to be cost neutral, there will be no reduction in the INQA GROUP fees for actuaries who are members of other organisations. There is also no concept of primary regulator: all INQA GROUP members are subject to our Code of Professional Conduct, regardless of any other organisation they may be part of.

You will need to check with the relevant legal authority, but the short answer is probably not.

Most (but not necessarily all, e.g. you can be Chief Actuary of a non life insurance company in the UK without being an IFoA Fellow provided you are not an IFoA member) reserved roles require either through legislation or statutory regulation that the holder is a current Fellow of the IFoA. Other countries may have similar requirements with regards to the relevant country associations (e.g. SOA/CAS for USA, ASSA for South Africa).

The situation in other countries may be different. But with regard to the UK, only about 10 % of IFoA Fellows work in a reserved role, so for 90% of Fellows this should not be a problem. For those who it might become one (e.g. because they are likely to be considered for a reserved role in the near future), it would be very unreasonable (providing the Fellow can provide evidence of having kept up good CPD [Continuing Professional Development] during any period of leaving the IFoA) for the IFoA to refuse to readmit the member prior to their taking up the reserved role. (The Fellow would of course need to meet the IFoA's requirements regarding obtaining a Practice Certificate).

For professional indemnity purposes, the key question that insurers normally want to know the answer to is:

- whether a person who says they hold an actuarial qualification genuinely obtained that qualification (i.e. if they say they passed the exams to become a Fellow of e.g. the Institute of Actuaries in year yyyy, is that correct).

Other questions that might be asked include:

- does the person follow a code of professional conduct and if so which one

- do they have a clean professional conduct record.

Qualified actuaries who have (and maintain) Verified status with INQA GROUP will be able to provide evidence (to brokers, but also to employers, clients and others) to answer the above questions by pointing to their publicly available entry in INQA GROUP's Find An Actuary page on the website. It is a condition of retaining Verified status that actuaries agree to abide by INQA GROUP's Code of Professional Conduct.

The level of charges set out above are designed to cover the costs of running and administering the organisation and website.

These include:

- reasonable secretariat time to verify that qualified actuaries are who they say they are and have passed the exams they claim to have passed

- infrastructure costs including website/database/file storage/bandwidth cloud charges and software licenses

- secretariat time in developing and maintaining the above

- secretariat administration time (e.g. responding to enquiries, sending out information to members, maintaining the International Qualified Actuaries Directory)

- building up reserves for any future disciplinary investigations and possible tribunals. (These are expected to be rare, but will need to be paid for if/when they arise).

The aim is not to make a profit over the long term, but to cover reasonable costs and to avoid any significant cross subsidies across different categories of members or different types of services. Covering possible future disciplinary cases is different and requires a form of insurance including initially building up reserves while membership numbers build up. There are also initial setup costs (including developing the initial infrastructure) which will need to be recouped.

We are committed to a very high level of transparency as to how funds are spent.

Your INQA Group membership activates immediately upon successful payment, giving you instant access to all benefits for your chosen plan. There's no waiting period or delayed activation, although a Pending label appears next to your name while we complete the verification process.

Perfect timing for IFoA members: Since IFoA subscriptions are due October 1st but can be delayed until December 31st (with increasing surcharges), you can join INQA Group from or before October and evaluate our value before facing IFoA's penalty deadlines. Our monthly membership gives you complete flexibility during this decision window.

If you're coordinating with other professional body renewals (like IFoA, ASSA, etc.), please contact us at secretariat@inqa.group - we're happy to help you manage the transition smoothly.

IAA/AAE membership fees are not included because a) they are fixed by the IAA/AAE (around £20 per qualified member for each of IAA and AAE), and b) INQA GROUP would not be eligible to join IAA fully until it has been in existence for 3 full years and joining the AAE would require a MRA (Mutual Recognition Agreement). In any case, whether INQA GROUP joins the IAA (or AAE) in due course will be up to members.

JOIN A MODERN ACTUARIAL ORGANISATION

JOIN A MODERN ACTUARIAL ORGANISATION

JOIN ONE OF OUR NEW PLANSReady to join? The process is simple

Begin your verification process with our streamlined online application. Verification typically takes a few days.

Explore Membership Options